What Is an FHA Loan? Requirements, Limits, and Benefits

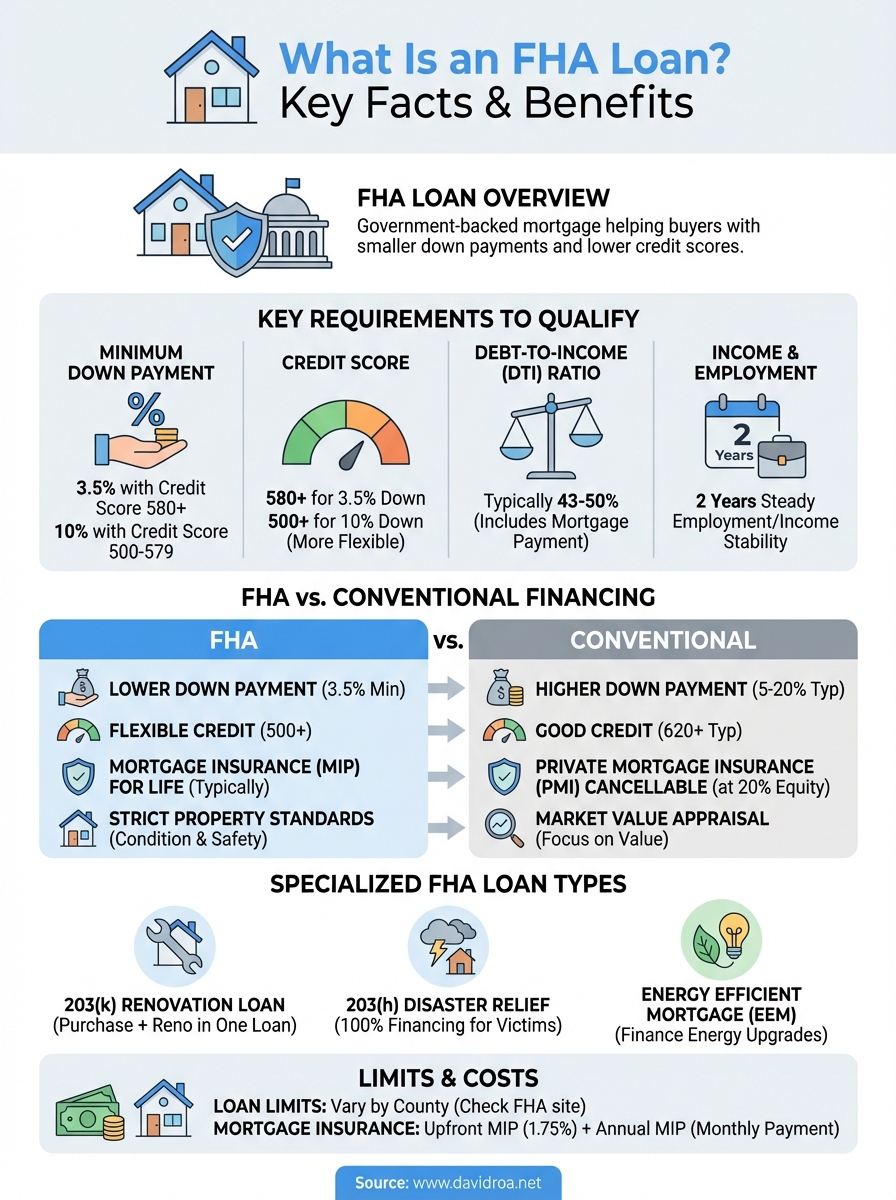

What is an FHA loan? It's a mortgage backed by the Federal Housing Administration that helps people buy homes with smaller down payments and lower credit scores than traditional loans require. The government insures these loans, which means lenders take less risk and can offer more flexible qualifying terms to borrowers who might not fit conventional lending boxes. You can put down as little as 3.5 percent and still get approved with a credit score of 580 or higher.

This guide walks you through everything you need to know about FHA financing in 2026. You'll learn how FHA loans stack up against conventional mortgages, what requirements you must meet to qualify, and which specialized loan types fit different homebuying goals. We'll also break down current loan limits, explain how mortgage insurance works, and show you the five steps to apply. Whether you're buying your first home or need more flexible financing options, understanding FHA loans helps you make smarter decisions about your mortgage.

Why an FHA loan might be your best mortgage option

You face real advantages with FHA financing that conventional mortgages simply don't offer. These loans remove common obstacles that stop many qualified buyers from purchasing homes, especially if you're starting out, rebuilding credit, or working with limited savings. Understanding what is an FHA loan and how it serves different financial situations helps you recognize when this program makes the most sense for your homebuying goals.

Lower barriers to homeownership

FHA loans require just 3.5 percent down if your credit score hits 580 or above, which means you need only $7,000 to put down on a $200,000 home. Conventional mortgages typically demand 5 to 20 percent down and credit scores in the 620 to 740 range for competitive rates. Your debt-to-income ratio can reach 43 to 50 percent with FHA backing, while conventional lenders usually cap that figure at 43 percent or lower.

Lenders also show more flexibility with your credit history under FHA guidelines. You can qualify just two years after a bankruptcy instead of waiting four to seven years for conventional approval. Foreclosures require only three years of recovery time rather than the seven years most conventional programs demand. This matters if you've faced financial setbacks but have since stabilized your income and spending habits.

FHA loans give you a realistic path to homeownership even when traditional financing keeps the door closed.

Protection when financial challenges arise

Your FHA loan comes with built-in loss mitigation options that conventional mortgages rarely match. If you lose your job or face medical expenses, you can request forbearance for up to 12 months, giving you breathing room to recover without immediate foreclosure risk. The FHA also offers loan modification programs that can reduce your interest rate or extend your repayment term when you're struggling to keep up with payments.

These safety nets prove especially valuable during economic downturns or personal crises. Conventional lenders have fewer formal programs and typically handle hardships on a case-by-case basis with no guarantees. Your FHA loan includes clear guidelines that protect you when circumstances beyond your control threaten your ability to pay.

Access to renovation financing

FHA 203(k) loans let you purchase and renovate a property with a single mortgage, which eliminates the need for separate construction financing or personal loans. You can buy a fixer-upper for $180,000, finance $50,000 in repairs, and roll everything into one loan with the same low down payment requirements. Contractors get paid directly from an escrow account as work progresses, and you start making payments on the full amount once the project completes.

This option opens up opportunities in neighborhoods where move-in-ready homes cost more than you can afford. You transform outdated properties into exactly what you want while building equity through improvements. Traditional renovation loans exist but usually require higher credit scores, larger down payments, and more complex approval processes that make them harder to access for first-time buyers or those with moderate credit profiles.

Sellers also view FHA offers more favorably than many buyers realize. Your financing comes with government backing and clear underwriting standards that reduce the chance of last-minute denials. Real estate agents recognize that FHA loans close reliably when you meet the documented requirements, giving you genuine negotiating power in competitive markets.

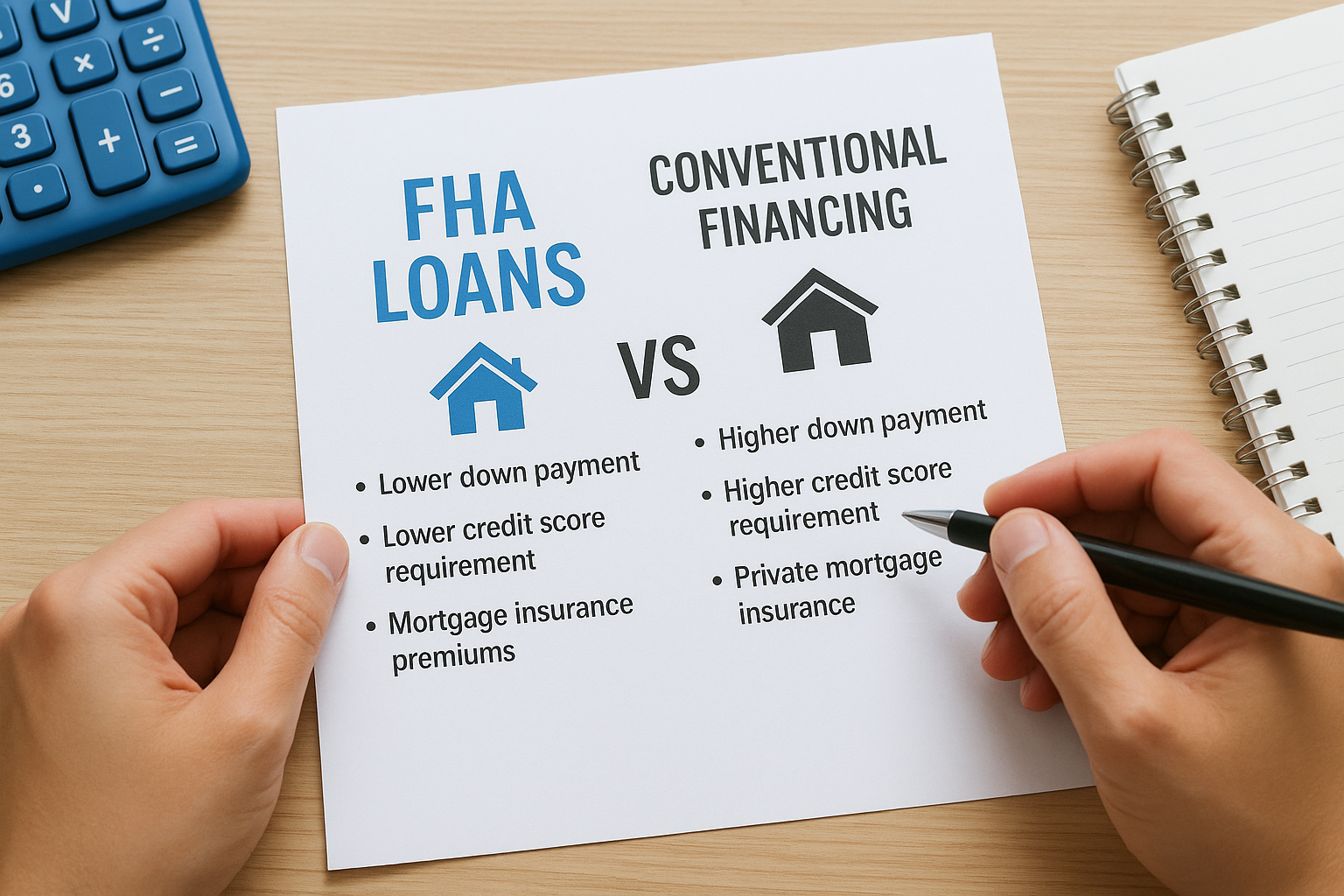

How FHA loans compare to conventional financing

Understanding what is an FHA loan relative to conventional mortgages helps you choose the right financing path for your situation. These two loan types serve different borrower profiles and come with distinct cost structures, qualifying standards, and long-term financial implications. The differences affect your upfront cash needs, monthly payments, and total interest paid over the life of your loan.

Down payment and credit score differences

You need significantly less cash to close with FHA financing compared to conventional options. FHA loans accept 3.5 percent down with a 580 credit score, while conventional mortgages typically require 5 to 20 percent down depending on your credit profile and lender policies. A $250,000 home costs you $8,750 upfront with FHA versus $12,500 to $50,000 with conventional financing.

Credit score requirements create another clear divide between these programs. Your FHA approval becomes possible with scores as low as 500 if you can manage a 10 percent down payment, giving you access to financing that conventional lenders would automatically reject. Conventional loans reward higher credit scores with better interest rates, but they shut out borrowers below the 620 threshold entirely in most cases.

Mortgage insurance structures

Both loan types require mortgage insurance when you put down less than 20 percent, but the costs and duration differ substantially. FHA charges an upfront mortgage insurance premium of 1.75 percent plus annual premiums between 0.45 and 1.05 percent of your loan amount. You pay these annual premiums for the entire loan term if you put down less than 10 percent, which means refinancing becomes your only exit strategy.

Conventional loans let you cancel private mortgage insurance once you reach 20 percent equity, while FHA insurance typically sticks with you until you refinance or pay off the loan.

Conventional private mortgage insurance costs between 0.3 and 1.5 percent annually based on your credit score and down payment. The key advantage appears when you hit 20 percent equity through payments or appreciation, as you can request cancellation and eliminate this monthly expense. Your FHA insurance continues regardless of equity gains, making conventional financing cheaper over time for borrowers who can qualify.

Property standards and appraisal requirements

FHA appraisers enforce stricter property condition standards than conventional inspectors apply. Your potential home must meet minimum property requirements covering structural integrity, safety systems, and habitability before the loan can close. Peeling paint, broken handrails, or faulty electrical systems force repairs that sellers must complete or credit you to handle after closing.

Conventional appraisals focus primarily on market value rather than property condition, giving you more flexibility to purchase homes that need cosmetic updates or minor repairs. This matters when you're competing for properties in tight markets where sellers resist making fixes before closing.

Requirements you must meet to qualify today

FHA qualification standards balance accessibility with responsible lending practices. You face specific benchmarks for credit, income, debt, and property use that determine whether you can secure financing. These requirements apply uniformly across lenders since the FHA sets the guidelines, though individual banks may add overlays that tighten standards beyond the federal minimums. Understanding what is an FHA loan means knowing exactly what qualifies you and where you stand before you start the application process.

Credit score minimums and exceptions

Your credit score of 580 or higher unlocks the standard 3.5 percent down payment option that makes FHA loans attractive to most borrowers. Scores between 500 and 579 still qualify you for FHA backing, but you must increase your down payment to 10 percent of the purchase price. Lenders pull reports from all three credit bureaus and use the middle score when determining your eligibility, so one low report won't necessarily disqualify you.

Recent credit problems don't automatically eliminate your chances. You can apply just two years after bankruptcy discharge or three years after foreclosure completion, assuming you've reestablished positive payment patterns and can document the circumstances that caused your financial distress. Late payments within the past 12 months raise concerns, but lenders evaluate the full picture rather than rejecting applications based on isolated incidents.

Income and employment verification

You need two years of steady employment in the same field or with the same employer to satisfy income stability requirements. Lenders accept W-2 wages, self-employment income, Social Security benefits, disability payments, and retirement distributions as qualifying income sources. Your tax returns, pay stubs, and bank statements prove this income, and underwriters calculate a monthly average that supports your requested loan amount.

Self-employed borrowers face extra documentation requirements but can absolutely qualify with two years of tax returns showing consistent earnings.

Debt and occupancy standards

Your debt-to-income ratio must stay below 43 to 50 percent depending on compensating factors like high credit scores or cash reserves. This ratio divides your total monthly debt payments by your gross monthly income, including the proposed mortgage payment. You must also occupy the property as your primary residence within 60 days of closing, which means investment properties and second homes don't qualify for FHA financing.

Specialized FHA loan types for different goals

The FHA offers variations beyond standard purchase loans that address specific homebuying scenarios and property needs. These specialized programs maintain the same low down payment benefits and flexible credit requirements as traditional FHA financing while adding features that serve unique situations. Knowing what is an FHA loan in its various forms helps you match the right product to your circumstances, whether you're renovating a property, recovering from disaster, or improving energy efficiency.

203(k) renovation loans for fixer-uppers

Your 203(k) loan combines purchase financing and renovation costs into one mortgage payment, eliminating the need for separate construction loans or cash-out refinances. You can borrow up to the after-repair value of the property, which means a $150,000 home can support $50,000 in improvements if the completed value justifies the combined $200,000 loan amount. Contractors receive payment through a controlled disbursement process as they complete approved work phases.

Two versions serve different renovation scales. The Standard 203(k) handles structural repairs, room additions, and major systems replacements exceeding $35,000, while the Limited 203(k) covers cosmetic updates and minor improvements up to $35,000. You work with an FHA-approved consultant on Standard projects who ensures contractors meet building codes and project timelines.

FHA 203(h) for disaster victims

Disaster survivors gain access to 100 percent financing through the 203(h) program if your home was destroyed or severely damaged in a federally declared disaster area. You face no down payment requirement and can finance closing costs into the loan, removing financial barriers when you're already dealing with loss and recovery expenses. Your application requires proof that you lived in the disaster area and lost your primary residence.

The 203(h) program removes down payment obstacles precisely when you need support most after losing your home to disaster.

Energy Efficient Mortgage program

You can finance energy-saving improvements worth up to $4,000 or 5 percent of the property value through the FHA Energy Efficient Mortgage without increasing your down payment. Solar panels, new HVAC systems, improved insulation, and energy-efficient windows qualify when a home energy assessment identifies specific upgrades. These improvements reduce your monthly utility costs while the financing spreads over your 30-year mortgage term at the same interest rate.

Understanding FHA loan limits and insurance costs

Your FHA loan amount faces county-specific caps that reflect local real estate prices, and you'll pay two types of mortgage insurance that add to your monthly housing costs. These limits and insurance requirements directly impact how much you can borrow and what you'll actually spend each month beyond your principal and interest payment. Knowing these numbers before you start shopping helps you budget accurately and avoid surprises during the application process.

County-based loan limits that vary by market

FHA sets maximum loan amounts based on median home prices in each county, which means your borrowing power changes depending on where you buy. The 2026 floor sits at $498,257 for single-family homes in most low-cost areas, while high-cost markets like San Francisco and New York reach $1,149,825 for the same property type. You can check your specific county limit through the official FHA website before you commit to a purchase price.

These limits apply to your base loan amount before you add financed mortgage insurance premiums or other costs. Properties with two to four units have higher caps since they generate rental income, giving you more flexibility if you plan to house-hack by living in one unit and renting the others.

Upfront and annual mortgage insurance premiums

You pay an upfront mortgage insurance premium of 1.75 percent of your loan amount at closing, which you can finance into your mortgage rather than paying cash. A $200,000 loan generates a $3,500 upfront premium that gets added to your balance, increasing what you owe but preserving your available cash for moving expenses and reserves.

Your annual mortgage insurance premium continues for the life of most FHA loans, unlike conventional PMI that you can cancel after reaching 20 percent equity.

Annual premiums range from 0.45 to 1.05 percent based on your loan amount, loan-to-value ratio, and repayment term. Loans above $726,200 carry higher rates, as do 30-year terms compared to 15-year mortgages.

How insurance costs affect your monthly payment

Your monthly housing cost includes principal, interest, property taxes, homeowners insurance, and mortgage insurance premium. That annual MIP divides into 12 monthly payments that appear as a separate line item on your mortgage statement. A $200,000 loan at 0.55 percent annual MIP adds roughly $92 to your monthly payment, which you must factor into your debt-to-income ratio calculations.

Understanding what is an FHA loan means accepting these insurance costs as the trade-off for low down payments and flexible credit requirements. You can eliminate MIP by refinancing to a conventional loan once you build 20 percent equity, though you'll need to meet stricter conventional lending standards at that point.

How to apply for an FHA loan in five steps

The FHA application process follows a predictable path that takes most borrowers 30 to 45 days from pre-approval to closing. You complete five distinct steps that build on each other, starting with lender selection and ending with your signed loan documents. Understanding what is an FHA loan application requires makes each phase less stressful and helps you prepare the right documentation upfront.

Find an FHA-approved lender and gather your documents

Your first step involves identifying a lender approved to originate FHA loans, since not all mortgage companies participate in the program. You can search the official FHA lender list or ask for recommendations from your real estate agent. Once you select a lender, you'll provide two years of tax returns, recent pay stubs, bank statements, and identification to verify your income and employment history.

Pre-approval comes next after your lender reviews your credit and finances. This process generates a pre-approval letter that shows sellers you qualify for financing up to a specific amount, strengthening your offer in competitive markets.

Search for property and complete the appraisal

Step three starts when you find a home and submit an offer. Your lender orders an FHA appraisal once the seller accepts, which evaluates both market value and property condition against FHA minimum standards. The appraiser checks for safety hazards, structural issues, and required repairs that must be addressed before closing.

Properties that fail inspection create two options: the seller completes required repairs, or you negotiate a credit to handle fixes after closing. Your lender cannot approve the loan until the property meets all FHA requirements.

Navigate underwriting and close your loan

Your application enters underwriting where a loan processor verifies every document and ensures you meet all FHA guidelines. You might receive requests for additional paperwork or explanations about deposits, debts, or employment gaps during this phase. Answer quickly to avoid delays.

The underwriting phase typically lasts 7 to 14 days if you submit complete documentation and respond promptly to all requests.

Final approval triggers your closing date. You'll review a Closing Disclosure three days before signing that details your final loan terms, monthly payment, and closing costs. Bring a cashier's check for your down payment and closing costs, then sign your loan documents to complete the transaction.

Closing thoughts on FHA financing

FHA loans remove financial barriers that keep qualified buyers out of homeownership. You gain access to 3.5 percent down payments, flexible credit requirements, and government-backed protection that conventional mortgages don't match. Understanding what is an FHA loan and how it serves your specific situation helps you make confident decisions about your financing path, whether you're purchasing your first home, renovating a property, or rebuilding after financial setbacks.

Your approval depends on meeting documented standards for credit, income, and debt that reward stability rather than perfection. Mortgage insurance costs add to your monthly payment, but they enable homeownership years earlier than saving 20 percent down would allow. The trade-off makes sense when you consider building equity and locking in housing costs versus waiting indefinitely for perfect conventional qualifications.

Work with an experienced mortgage professional who understands FHA guidelines and can guide you through every step from pre-approval to closing. The right lender streamlines your application and ensures you maximize every advantage FHA financing offers.